Did you know that your due diligence when buying from a developer completely differs from buying a house or apartment already built? Have you ever put money down on a real estate project that did not happen? I did, and I’m a seasoned real estate broker in Costa Rica and have lived here since 1980. And I went on my face.

Learn from others’ mistakes so that they won’t happen to you.

Developing a property here is not so simple. There are a few important issues that you should know about, so it’s easier to understand what you can do to make a safe purchase. Compare our market, the regulations, and consumer protection to what happened in the 2006 housing bubble.

- Most real estate developers don’t have the money to buy the land they will develop and even less the capital to develop their projects.

- The developer finds a property seller willing to accept an earnest money deposit and put the property in trust. Once the developer starts selling the property, the land owner will receive a higher price than the market value. Then the developer will try to pre-sell 60% of their project (or the first phase), so the bank will lend them the capital to build the project, often in phases.

- You, the client, will sign a purchase-sale agreement covering the developer but not you, the buyer.

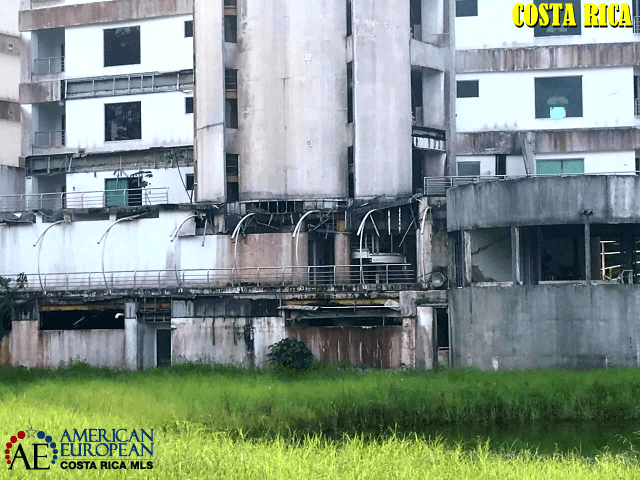

Sonesta One Jaco

I have been a real estate broker here for over 30 years. During the 2006 housing bubble, there were very few large real estate developers here, and there was an incredible need for residential development in the Central Valley and the coastal areas. Believing that the boom would hold for a few years, many invested to flip the property at a higher price. My wife and I thought it was a good time to invest in a project in Jaco. Beach. Unfortunately, we invested with 156 other buyers in Sonesta One Jaco resort. The developer offered this beautiful project as “Imagine owning here.” Well, I never imagined I would have my investment tied up in court after using it for like six months and then not be able to even get into the building. See how this beautiful project went to hell in the images.

This real estate developer built Riverside in Escazu successfully and did another small project in Tambor Beach. Unfortunately, $16 Million got lost in some crazy escrow deal, created by the developer and escrow company. The banks (Lafisse and BCIE) sued the developer and vice versa, and now, in 2023, the buyers are still hung out to dry. The banks haven’t even allowed owners or city appraisers in the building. The municipality charges property tax and garbage pick up for all those years. And they have not been willing to declare the building not inhabitable. The municipality says it’s unfinished, but I think it’s abandoned. Decide for yourself by looking at the pictures.

Here are some facts:

12 Facts

- Most real estate developers do NOT work with real estate agents unless you pay the agent a buyer’s agent fee.

- First, visit the projects you’re interested in. If it’s a pre-sale, the title probably is non-existent until finished.

- Developers usually charge a $5K deposit, directly payable to them. Once you have decided to purchase and sign the purchase-sale agreement, you must pay 25% less the $5K within a certain period. This money also goes directly to them.

- This is done this way for residents and citizens who need a bank mortgage so that the bank can finance 75%

- The developer uses their own lawyer for the purchase-sale agreement, which will protect them 100% if you walk and don’t close for any reason. they will tell you

- There is still no title while you’re paying the first 25% of the unit.

- Often, the developer creates a corporation for each unit, so a title transfer is easy by transferring the shares and powers of attorney.

- As soon as your unit is finished, the developer will ask you to close it. Most of the time, the rest of the project, including common areas amenities, are then not finished, so you’ll pay in full for something that’s not finished.

- The developer, when asked how much the HOA fees will be, is much lower than it is after delivery of the project to the HOA administration.

- A home inspection is never included in the purchase-sale agreement.

- The contract will make a statement about what will happen if the buyer doesn’t pay/close in time, but there won’t be anything to protect the consumer in case the developer runs late in delivery.

- The option to purchase-sale agreement must be registered in the National Register as soon as the title is created. BUT, if the developer goes bankrupt and the closing does not happen as stipulated, the option will disappear from the register after the closing date. Of course, your 25% will be lost.

So what to do before you buy?

1. Always hire your OWN lawyer for due diligence and to protect you before you sign any agreement with the developer or give them any money. Don’t even pay the first $5,000. And please use a lawyer who speaks your language and specializes in real estate.

2. Check with the Ministry of Economy if the developer is registered under “lista de proyectos autorizados”

3. Ask them for information on their finished projects and visit those.

4. Ask to use escrow or fideicomiso to deposit all the money you pay them, and ask your lawyer to include important controls such as a home inspection and hold-backs.

5. Hold back as much as possible until the whole project is finished.

6. Do not buy in a multi-phase project.

7. Make a clear statement in the option to purchase-sale agreement that if the developer has not been able to finish your unit on the closing date, you must be fully reimbursed for the amounts deposited into escrow.

8. I am sure your lawyer can devise other ways of protecting your investment.

Smart investment

Costa Rica has very nicely finished real estate projects everywhere. I can’t keep up with all the names of the hundreds of condominiums nationwide anymore. Successful and responsible developers built all these condominiums with a good track record. Some are 8 – 25 floor high apartment buildings; others are gated communities with hundreds of townhouses, and they have happy buyers.

Are you planning to purchase your Costa Rica beach condo or retirement home from a real estate developer? Then do your due diligence. Rather than talk up (or take down) a particular development, I thought it would be better to give you a tool. A great tool that will help you consider your purchase objectively. I hope you use it and if you don’t, don’t complain.

Please do not waste your money, do it better than I did. This Quiz is a gift from the American European Real Estate Group in Costa Rica; enjoy it.

Contact us NOW for your Costa Rica real estate purchase.

1 Comment

I wish I read your articule before signing the contract.

Ziggy