Estimated Reading Time: 5 Minutes

Did you know that every Costa Rica property owner must present a property value declaration every 5 years? Probably not, eh…

In most countries worldwide, property owners receive notice from the tax authorities that they have to pay their property taxes. Not in Costa Rica, though! Like many other things in this beautiful country, things function differently. I know it’s a weird situation, but that’s what it is, and you should know about it.

Since 1995, every Costa Rica property owner has been obliged to present a property value declaration in the Municipality where this property is located. This declaration, called “declaracion de bienes inmuebles“, must be presented by the property owner in person every 5 years. If you are not here, you must give someone a power of attorney to sign the declaration.

If the owner has passed away, the executor of the estate or the legal inheritors must declare.

Some municipalities will allow an original signature on the form. Also, the form can be FedExed to someone in Costa Rica who can present the declaration.

When Selling

If you are selling your property, the buyer’s attorney will request the last property value declaration, which is part of the due diligence process. Then, if you haven’t presented it, and you catch it in time, no harm has been done, unless you don’t agree wth what the municipal representative puts the value at.

Check it out yourself

Can you read Spanish, or are you able to use Google Translate? Then, you can check the Property Tax Law or “Reglamento a la Ley de Impuesto sobre Bienes Inmuebles,” DECRETOS Nº 27601-H, which reads in Article 27:

Obligation of the declaration of real estate

This is what the law says:

Taxable persons are obliged to submit, to the municipality where their real estate is located, a statement of the estimated value thereof, in accordance with articles 6 and 16 of the Law, regardless of whether they are not subject to the tax. These declarations of real estate must be carried out by taxable persons at least every five years.

Find out the actual value

It is not easy to figure out how to calculate the value of your property. You can ask the municipality first what your property is valued at and if you want to change anything.

Then, you must present the property value declaration form to the municipality where the property is located.

The property tax is an annual 0.25% over the registered value. Property owners who pay ¢300,000 per year have a registered property value of ¢120,000,000.

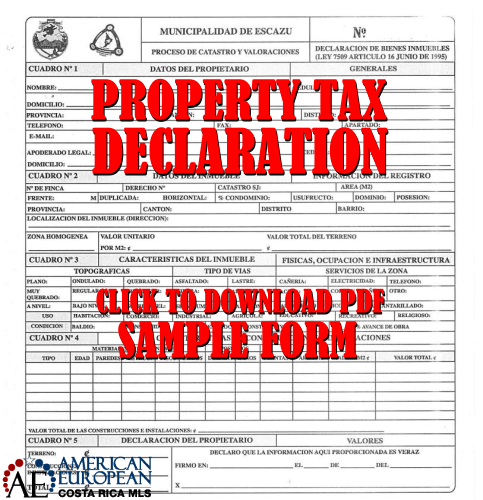

The property value declaration form

To get the property value declaration form, you can go to your municipality or try to find it online. If you don’t know how to calculate the value of your land and the construction, you can ask a city engineer to assist you in filling out the form. In my opinion, it’s not worth trying to calculate it yourself, as the engineer will change it anyway.

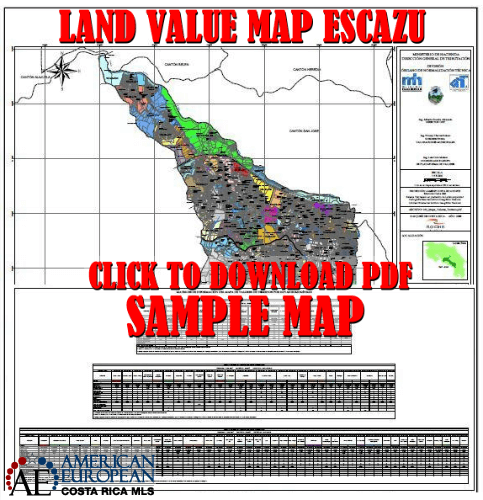

Land values

The Finance Ministry (Ministerio de Hacienda) regulates land prices to be used to calculate property value. Unfortunately, you must search for the updated values on the municipal website on Google as “MAPA DE VALORES DE TERRENOS POR ZONAS HOMOGÉNEAS.”

Construction cost

When you try to fill out the construction cost of all the buildings on your property, you really get to the hard part. You need to know which value to apply to the construction type on the property. Download this updated construction-type value manual from the Finance Ministry. (download PDF)

Also, the simple and easygoing way is to find out what it would cost to build the structures in today’s market and deduct 2% for each year of construction. That will take care of the depreciation of those structures.

An obligation

The municipality must accept your signed form with any calculation that you feel is correct. Hence, the municipality’s engineering department will get back to you in about one year and tell you whether your presentation was acceptable. So if you’re in a hurry to obtain a declaration stamped by the municipality, go with the calculations of the engineering department.

If you don’t present

It is possible that if you don’t present the mandatory property value declaration, the municipality will do it for you. As a result, you will have to accept their calculation, and discussion is impossible.

A fine

You must present the property value declaration every 5 years. Therefore, the municipality obliges property owners to present the declaration when they want to sell the property. If the property value is higher than the last one presented, the municipality charges a fine of 100% of the amount they did not receive.

Therefore, if you have purchased a property from one of our affiliate partners in the past, you can request their assistance. Contact us now to purchase a property from a well-informed real estate agent.

Image by stockking and Image by stockking on Freepik