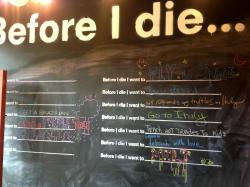

Retirement always evolves, does yours too? About a year ago, I wrote an article about planning your Costa Rica retirement. It centered around the use of a ‘Bucket List’ or ‘Painting a Picture’. Tools designed to help organize your thinking about what retirement will involve.

Retirement always evolves, does yours too? About a year ago, I wrote an article about planning your Costa Rica retirement. It centered around the use of a ‘Bucket List’ or ‘Painting a Picture’. Tools designed to help organize your thinking about what retirement will involve.

I’m still amazed how many people still think only in terms of: How much money do I need? I state it once more. Retirement always evolves, so the answer changes.

If you don’t know what the target looks like or the other influencing factors, how can you really answer the question?

Clarifying the target

So let’s get back to the basic issue of clarifying the target. Let me repeat the critical components:

1) What are you going to do with your time?

2) What are the priorities of the critical components of your plans?

3) Write them down and re-evaluate them periodically

The re-assessment is what I want to focus on at this point. Mainly since the anniversary of my article seems like a good time to do this. Maybe the coming of your annual tax filing is a good point to do this, as you have probably taken a look at a lot of your personal information.

There is a dimension to retirement planning that I failed to mention and hope to correct with this new article. Previously I stressed the importance of pre-retirement planning and still do. However, it sort of implies that once you retire, everything is said and done. If you take that approach you may be in trouble. So, again, I want to emphasize the re-assessment process.

In approaching this process I believe we should add one more element to our written retirement plan. We should add a section that covers ‘Intangibles’. Those feeling that may or may not be rational that actually and frequently play an important role in your decision making. You can just label them as concerns and hopes. You don’t have to justify them, just document them.

They will likely provide a good backdrop to your decision making and when you come to doing your reassessment, it may be very beneficial to see how they have and how they should impact your decision making. The next time around you can give them more or less emphasis, as appropriate.

The influencing factors

When you started your Costa Rica retirement Bucket List or your Picture, it was generally based on goals and desires that grew over some period of time. Along the way, hopefully, you have considered all the critical components that impact the retirement decisions:

- Psychological and physical health

- Home

- Climate

- Family

- Interests

- Finances

- Estate planning

- Technology

- Religion etc.

However, you must clearly recognize that none of these things are constant and they change more rapidly than you might expect. Yes, retirement always evolves and there is nothing you can do about that.

For example, I have an older sister whose family has a small business in Texas and whose retirement picture involved spending time at their cabin on Lake Superior in Canada while the sons ran the business. This past year her husband and two sons have all died in separate health-related events. Her retirement picture has now changed dramatically. A couple of important points to the story: An annual review is not too frequent; don’t put off doing things that are important to your objectives. Retirement always evolves.

Society plays a key role

Many people are very much involved with the world around them while they are working and evolving in their first 50 to 60 years  of life. But frequently they have a mental shift when they “retire”. They have a thought process that they are just going to do their thing and let the world do its thing. They’ve done their part, now others can take over. However, things don’t really work that way. Retirement always evolves.

of life. But frequently they have a mental shift when they “retire”. They have a thought process that they are just going to do their thing and let the world do its thing. They’ve done their part, now others can take over. However, things don’t really work that way. Retirement always evolves.

Society keeps moving with critical court rulings that affect health matters, marriage issues and the legal implications that stem from the rulings. Then there are the tax and benefit decisions that affect pensions, income levels and decisions about inheritance practices. Just consider the amount of change in the financial markets in the last 12-24 months. Regulations on nursing homes may play a role in your life or in the lives of those who you are expected to care for.

Technology impact

Now consider the impact of technology on phones, computer tablets and Skype and other communication tools that are changing so rapidly you can easily get lost in the dust. It has an impact on you and your family. You need to review such changes. Or you will wake up one day and say I haven’t talked to my grandkids in 3 months I wonder what is going on with them?

Planning, review, and revision is all part of retirement. You must take the effort to make it what you want, not to have it be something that just happens to you.

The Author

By guest blogger Ardon Schambers. Mr. Schambers leads a team of highly experienced HR professionals that have the knowledge, creativity, and breadth of understanding to meet each organization’s unique requirements in today’s demanding business climate. They are now creating a comprehensive educational tool for retirement planning.

Feel free to leave your comments on this blog. If you like this article, please feel free to share it on your social media.

If you like this blog, connect with me on Google+ or subscribe to our newsletter by clicking the banner below.

While we’re at it, I DO want to remind our readers that we appreciate any referrals you can send us. Finally, please remember the American-European real estate Group’s agents when you refer a real estate agent. Because we DO appreciate your business.