Estimated Reading Time: 6 Minutes

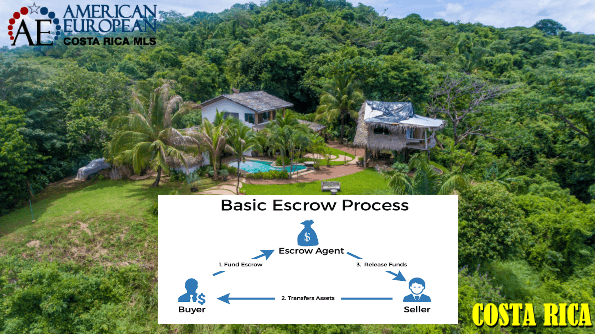

The safest way to buy real estate in Costa Rica is through escrow services.

These services are a secure way to transfer funds between a seller and a property buyer. The escrow company is a third party that handles these funds in return for a fee. This fee is usually 0.25% of the funds to be wired, with a minimum of $900.

Many Costa Ricans and even local attorneys don’t even know what escrow services are. That’s because Costa Rican buyers deposit the earnest money directly to the seller. AND the seller can deposit the balance to the seller from their bank account.

Nonetheless, when you are a foreign buyer, and your money to purchase a property comes from another country, you need a place to park this money. AND you have to prove the origin of the funds.

The easiest and safest place to do all this is to your the escrow services of a local escrow company. Ask your real estate agent which escrow company they feel most comfortable with, or supply you with a list.

Of course, if you do have a local bank account, personal or corporate, you can bring a cashier’s check made out to the seller to the closing. But then you still have to cover the problem of the earnest money deposit, the closing fees, and the realtor fees. So let’s take you through the steps, and you’ll see how well this functions if done the right way.

SUGEF

For many years, only attorneys specializing in real estate would have an escrow account for their clients. Until SUGEF (the Superintendencia General de Entidades Financieras), the Financial Institution Superintendency started controlling them.

SUGEF controls all escrow services. Therefore this is the safest way to use a third party to hold the money until closing.

Bank Account

If you are a foreign buyer and don’t have legal residency in the country, you won’t be able to open a bank account. Therefore, to make an earnest money deposit and the balance of the total transaction amount, using escrow services is a perfect and safe way of doing business.

Earnest money deposit

When buying real estate in Costa Rica, you first make your offer. Once accepted, your lawyer will write up a formal agreement called a purchase option. The buyer will have to take the property off the market and will want to see an earnest money deposit. This earnest money is usually 10% of the agreed sales price, which is negotiable. Ticos hand this earnest money over to the seller, but this is not a safe way of doing business.

Open escrow

The escrow company cannot open escrow until both parties sign the purchase option. The escrow company will not confirm the amount of the escrow fees until you tell them how much money you will send. Then they also tell you what documents you have to supply so that they can open escrow for you. These documents are mandatory for any real estate transaction in compliance with Law 7786. This is the law on narcotics, psychotropic substances, drugs of unauthorized use, related activities, money laundering, and financing of terrorism.

- Copy of the passports – A clear copy of the passport(s) of the buyer(s) is needed.

- Know Your Customer form (KYC) – The buyer(s) fill out this form to show who they are, their source of income, and if they are a Politically Exposed Person (PEP).

- Origin of Funds – The last three bank statements of the account from where the money will be wired show the property purchase amount. If there is a sale of a property in another country involved, a copy of the deed in Spanish or English or translated from another language is requested.

- Apostille – Some banks require to apostille all those documents.

Banks worldwide have these same norms, so complaining will not get you past these requirements. In addition, banks and real estate agents must check these data with various international organizations.

Closing

About a week before the closing date, ask the escrow company to tell you when to wire the transaction balance. At this point, they may require more documents.

Disbursements

The beauty of using escrow services is that they deliver a closing statement. At the closing, the escrow distributes all payments to the parties involved:

- Seller

- The government, for taxes and stamps

- Banks that hold an eventual mortgage to the property

- Notary public who does the closing

- The real estate agent(s) involved in the transaction

Be Aware

Out of the country escrow

A few escrow companies use their escrow in the United States. However, when the escrow is in another country, be aware that the purchase agreement cannot legally be contested if there is a problem or dispute. The United States has escrow laws, and Costa Rica does not.

Out of the country transaction

Often the funds don’t have to come here necessarily. If the buyer and the seller are from the same country, they can wire the money to each other. Then the real estate agent still must request the KYC and origin of funds to comply with law 7786. The agent has to invoice the commission as proof of the income, which the bank will request as soon as the commission arrives at the realtor’s bank account. Unfortunately, the notary public doesn’t have this obligation, which is why these money laundering laws make no sense to us.

The seller, national or foreign, must prove to their bank the origin of the funds by showing the sale deed. Therefore, always request the closing notary an authenticated copy of the deed at the closing.

Our recommendation is to use escrow services for every real estate purchase. Contact us now to purchase or sell property with our expert assistance.

Image used: Lifeguard photo created by wayhomestudio – www.freepik.com

2 Comments

When the escrow funds are placed into the escrow company’s account, is there interest payable to the buyer at closing? Can you request these funds be placed in bank account that earns high interest rate.

Sorry, Mike, it doesn’t function like that. But the funds won’t be more than a couple of days in escrow anyway. First deposit the earnest money (which is never more than 10%) and the balance will only be sent a few days before closing. This is an escrow account, not a savings account. Sorry.