Estimated Reading Time: 4 minutes

The real estate agent, the closing attorney, and the buyer often forget about post-closing issues. Buyers usually assume these post-closing issues happen automatically. Well, in Costa Rica, nothing goes automatically. These post-closing issues seem so simple, and they are. You only have to wait until the property you bought shows as yours in the National Registry.

Some attorneys will inform the buyer and send proof of your new ownership by sending you a recent title search. Now you know that the property is in your name. But is that all you need to check on? You can check the title online if you haven’t heard from your attorney in a couple of weeks after the closing.

If you haven’t purchased any property in Costa Rica yet, we invite you to search on our MLS now.

Here are 4 important post-closing issues that you should start taking care of as soon as you leave the closing attorney’s office.

1. The Keys

You’re supposed to receive the keys to your new house at closing, but you don’t know how many copies there are. Handymen, real estate agents, neighbors, the family of the former owner, and many others might have the keys to the gate and the front door.

Call a locksmith ahead of time and have him change the important locks of your new house before you move in. You can save money by changing the cylinder only. You can even change the cylinder yourself if you feel up to it.

2. Utilities

Dealing with the utilities on the Property you have purchased is one of the most important post-closing issues. If you don’t get this out of the way, you might have water, power, or any other essential utility disconnected, and find out when it’s too late.

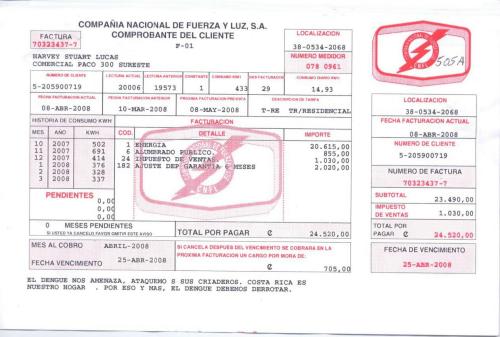

During the due diligence period, your lawyer should receive copies of all the paid utilities. These will contain all the necessary information about the meter number, the location, the NIS or NISE number, etc. See a sample of an antique bill that shows all the information you’ll find online now.

Changing the Name on the Utility Bills

Most sellers are very cooperative and don’t care if you leave it in their name for a while. The utility company might only transfer the service if you’re a resident or citizen. But I recommend you change the utilities to the same name as your property, in case you forget to pay and they’ll cut the service.

The new property owner is responsible for transferring utilities. The buyer can request the transfer once the National Registry records the property title transfer. Some utility companies require residency or citizenship to transfer utilities to your name. So, although this would appear to be a simple task, in Costa Rica, it is not.

If you are not a resident or citizen, ask your lawyer well ahead before the closing how to resolve this problem.

(b) Delivery of Utility Bills

Utility companies no longer send bills. When you request the service, the attendant will request your email address.

You can now find out how much you owe and when to pay on the utility company’s website. You only need the NIS number for the water bills at Consulte su facturación (aya.go.cr) and the NISE number for the electric bills at Consulta de Recibos (cnfl.go.cr).

If a different utility company services your property, ask your real estate agent to provide the information.

![Declaration of Property Value [Declaracion de Bienes Inmuebles] to update the value every 5 years Post Closing Issues by Attorney Roger Petersen](https://livingcostarica.com/wp-content/uploads/2022/05/BienesInmueblessm.jpg)

3. The Local Municipal Government

A registrar records the deed in the Property Section of the National Registry. This is the official national registry for recording titles to property. However, you pay property taxes at your local Municipal Government.

In most cases, the two are not automatically connected. This means that just because a sales deed is recorded in the National Registry, it does not mean that the Municipal government where the property is located knows about it.

Once the buyer receives the recorded property transfer deed back from the closing Attorney, it is the buyer’s responsibility to hand-carry a copy to the Municipal government to inform them of the transfer. Then, the Municipality can collect property taxes from the new owner.

As part of the due diligence, the seller should have completed a Declaration of Property Value [Declaración de Bienes Inmuebles]. Property tax law requires that property owners fill out this form every five [5] years. The Municipal Government uses this form to establish the property value, which is used to calculate the property tax. Usually, the engineering department will assist with the declaration, so ask for an appointment there. Some property owners elect not to fill out the form and by not doing so the Municipal Government has the right to conduct an appraisal of the property and set the property tax.

4. Property Tax

As part of the due diligence, when you purchased the property, the seller should have delivered a certification from the municipality showing that the property tax was up to date. Property tax is 0.25% of the registered value (see info about the declaration of the property value above). This tax is paid annually or quarterly. You can learn all about property and municipal tax now.

Send us an email with all your questions for more information about closings in Costa Rica or to connect you with an agent.

1 Comment

Gracias Ivo por tus excelentes blogs.

Juanjo de Santa Teresa / Peninsula Realty Agent