Are you buying a house in Costa Rica and needing bank financing to purchase? In that case, you need to qualify for a mortgage first. And you will also need a bank appraisal.

Are you buying a house in Costa Rica and needing bank financing to purchase? In that case, you need to qualify for a mortgage first. And you will also need a bank appraisal.

The Spanish name for a bank appraisal is “avalúo bancario” and an appraiser is “perito valuador”.

There are many more steps involved in getting the necessary bank financing in place. In this article I want to take you through those steps. This will show you what you can expect from a bank appraisal when you purchase a property in Costa Rica.

Once you are fully qualified for a bank mortgage and you have found the property that you love, it is time to send in the appraiser.

Every bank in Costa Rica functions differently when it is time for the bank appraisal. Some banks have appraisers on their payroll, others outsource an appraiser. This can make a difference in response time.

The appraisal cost

You loan officer will first ask you to deposit the cost of the appraisal. The cost of a bank appraisal runs anywhere between $300 and $1,000, depending on the bank. The cost of the appraisal depends mainly of how complete the appraisal is. Some banks include a home inspection.

Home inspection

It is possible that the appraiser finds a faulty electrical system, plumbing problems or maybe a termite infestation. In that case, the bank will request to make all the necessary repairs before approving the mortgage.

Problems might arise when that happens. If you have not included any contingencies such as an approved appraisal, you might end up having to pay for the repairs as a buyer.

Bank appraisal value

Most bank appraisal in Costa Rica is done by the Ross-Heidecke depreciation method. Real estate agents usually use the replacement method to calculate the value of your property.

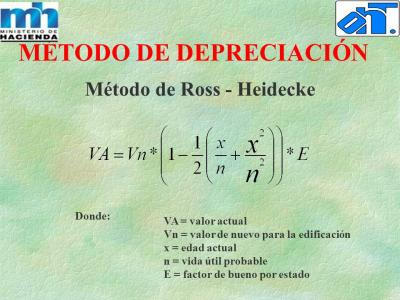

Ross-Heidecke

The Ross-Heidecke method is a depreciation method and is mostly used for a bank appraisal in Costa Rica, although heavily criticized by many appraisers.

The methodology consists in considering:

- The probable remaining physical life. This is the total period a building is expected to last.

- This qualifies the conservation of the building.

- The age of the construction

Normally the expected life of a building in Costa Rica is only between 50 and 60 years and for this reason, any building older than 50 years has very high depreciation.

Additional details

The appraiser also takes into account other valuable details on the property, such as:

- How close is the property to conflict areas?

- Which public services are available?

- How close is the property to rivers and creeks? What are the setbacks from the river?

- Is the property easily accessible?

- Are there any legal issues with the construction, such as property setbacks, zoning restrictions, or illegal construction?

- Are there any other factors that can influence the value of the property?

LTV

Loan To Value (LTV) is used to express the ratio of a loan to the value of the asset. Most banks in Costa Rica have always been lending at 80% of the appraised value. In the last few years, I see more and more often that banks lend closer to 100% LTV and even throw in the closing cost when you purchase from a real estate developer.

When the property is purchased from a private person, usually the LTV used by the bank is 70 or 80%. That means that you have to be able to pay 20 – 30% out of your pocket to be able to get the mortgage and purchase the property.

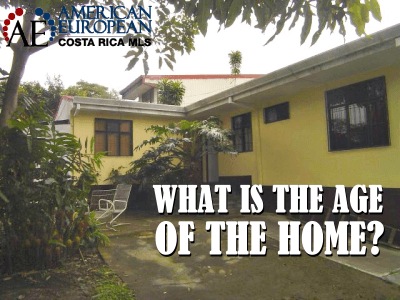

Age of a home

Most banks in Costa Rica will not give a mortgage over construction that is older than 25 years or give a much lower LTV than the usual 70 – 80%. If the home you are buying is older than 25 years, check on the bank’s age restrictions first before you go any further.

Private lenders

This article explains about a bank appraisal, which is used to apply for a bank mortgage. When you apply for a mortgage with a private lender, everything functions a little different. Most lenders use real estate agents to do their appraisals.

Unheard of in Costa Rica: Now, US Expats, with a credit score of 640 or higher and with verifiable income can get an unsecured personal loan up to $300,000. This loan can be used to buy property in Costa Rica. How long does it take to apply? Just a few minutes! Click on the banner, read the article and fill out the form.

Condition on the home

Real estate agents look at the replacement value, the market value and then set a fire-sale price. After foreclosing or when the lender repossesses a property, there is a good chance the house is trashed. For that reason, the real estate agent’s appraisal is at a fire-sale price, as a protection to the lender.

The replacement value

Real estate agents use mostly the cost of replacement to calculate the value of a property. When the construction is calculated, depreciation of 2% per year is taken into account. If there has been a major remodel, the depreciation is taken from the moment of the remodel.

To keep property transfer tax low the real estate values are often registered at a different value in the property register than the real value. Only when the property was purchased before with a mortgage, you can see how much the mortgage was at the moment of the purchase. Seasoned real estate agents know what land values are in the area that they cover. They also know the cost of construction, so to calculate the replacement value of a property is pretty easy to do.

Difference in values

Unfortunately, quite often it was not the agent but the seller who decided on the price to list a home. Therefore, quite often there is a difference between the sales price and the bank appraisal. Therefore, sometimes it happens that after the buyer and seller agree on the sales price, the bank might not approve the mortgage amount.

For that reason, I recommend you to make the offer subject to a bank appraisal.

For 25 more mortgage tips, go to this Tico Times article.

Contact us if you are looking to hire a seasoned real estate agent to purchase property in Costa Rica that needs a bank appraisal

Feel free to leave your comments on this blog.

If you like this blog, connect with me on Google+ or subscribe to our newsletter by clicking the banner below.

I DO want to remind our readers that we appreciate any referrals you can send us. Please also remember the American European real estate Group’s agents when your refer a real estate agent. We appreciate your business.