Supply & demand always affects the housing market, wherever in the world. As you all know, Costa Rica real estate is very connected with Florida real estate. Both are retirement markets and people look to move to warmer destinations as the weather keeps changing with more rain and colder.

Supply & demand always affects the housing market, wherever in the world. As you all know, Costa Rica real estate is very connected with Florida real estate. Both are retirement markets and people look to move to warmer destinations as the weather keeps changing with more rain and colder.

The Florida real estate market got hit hard when the bubble burst but the Costa Rica real estate market has been pretty stable, mainly based on a strong local purchase power from the young professionals who have great paying jobs from the US companies that moved to Costa Rica looking for cheaper labor. Costa Rica banks are very happy to give these young professionals a mortgage for their property purchase.

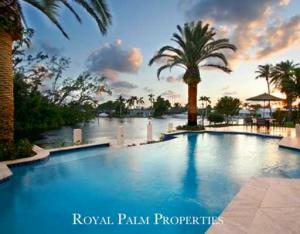

Because I believe that when the Florida real estate market comes back, Costa Rica will be right behind it and I foresee that when that happens, we will soon get lots of retirees from up north deciding to retire to Costa Rica again. For this reason, you will enjoy this article by Palm Beach – Florida realtor Jeff Lichtenstein who sells luxury homes in this area.

The housing market

For the past six years, economists and politicians have argued about what to do with the housing market. We’ve heard all sorts of solutions, from bulldozing homes to giving huge reductions in principal to homeowners upside down on their mortgages. President Obama blamed President Bush, Republicans blamed Barney Frank, and everyone blamed Wall Street. Quietly, though, as we start 2012 in Palm Beach County, overall inventory is significantly down. There were 9,593 homes available in February of 2012 versus 10,883 in 2011, almost a 12% drop in inventory.

I attribute the drop to a change in supply, not so much to a surge in demand. As evidenced by the number of sales staying the same, there has been a slow drop in supply since 2006.

Excess inventory

In 2006 we had a perfect storm of excess inventory, so Supply & Demand does it again:

1) Investor purchases of new construction

2) Builder speculation homes

3) Over-confident Sellers who purchased first without selling

4) Sellers who were in a must-sell situation

While we still have many Sellers in the 4th category of ‘Must Sell’, due to a loss of income or loss of job, 80-90% of the first three categories that I outlined have sold since 2006.

Drip, drip

Picture a slowly dripping faucet as a sale. Supply & Demand does it again. One drip doesn’t amount to much, but drips from 2006 to 2012 add up to an overflowing bathtub! That is what has happened in real estate over the last 6 years, and 2012 is the year the bathtub overflowed. The investor, builder, and over-confident Seller who got stuck with their good-looking homes have taken their 35% loss and moved on. These Sellers have gone through denial, trying to wait it out by renting their home, got angry at Wall Street, switched to 4 different real estate agents before they stopped blaming everyone and accepted reality. Finally, they have sold and moved on.

The bottom

The bottom

Now we are left with a just a bad economy and a lousy market. This market is stronger, though, because the one-time Investor/Builder Spec/Over-Confident inventory has dissipated. I’ve personally had 2 Buyers lose out on homes ranging from $500,000 to $4,000,000 in the past two weeks.

Buyers are in disbelief thinking they can wait forever only to lose out. Pending sales for March and April are going to be way up and buyers need to recognize the bottom is here, not because the economy is strong, but because there are no more investors investing, spec buildings being built, and over-confident Sellers buying first without selling first.

Turnaround

The turnaround in housing has begun because of the natural laws of Supply & Demand. In 2007, I explained to my 7-year-old son Sam, to picture a town with 100 homes and 100 people. If one person moves to the town each year, then one new home needs to be built. What happened in housing is that builders constructed 7 homes in one year, giving the town an excess of 6 extra homes.

After a 6-year-long wait with no homes being built, we have hit equilibrium. We now have 107 homes and 107 homeowners. Supply and demand are smoothing out. Watch for the Republicans and Democrats to fight over who gets credit. Sam, now 13, can tell you that the credit really goes to the free market principals of supply and demand.

The author

Jeff Lichtenstein specializes in the luxury real estate in Jupiter homes for sale and Palm Beach Gardens real estate in South Florida.

Feel free to leave your comments on this blog. If you like this article, please feel free to share it on your social media.

Also, if you like this blog, connect with me on Google+ or subscribe to our newsletter by clicking the banner below.

While we’re at it, I DO want to remind our readers that we appreciate any referrals you can send us. Finally, please remember the American-European real estate Group’s agents when you refer a real estate agent. Because we DO appreciate your business.

The bottom

The bottom