When living abroad as a US expat, you’re supposed to know what FBAR is. Do you? Filing a US expat tax return is a daunting task for many American expatriates.

When living abroad as a US expat, you’re supposed to know what FBAR is. Do you? Filing a US expat tax return is a daunting task for many American expatriates.

Although US citizens and green card holders are aware of foreign earned income exclusion, foreign housing exclusion, and foreign tax credit, many American expats do not realize the importance of FBAR.

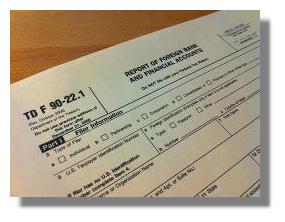

FBAR is the Report of Foreign Bank and Financial Accounts or the form TD F90-22.1. A failure to file FBAR can result not only in civil penalties but also in criminal prosecution.

Let’s review some FAQs about FBAR:

Who is required to file form TD F90-22.1?

U.S. citizens, green card holders, and US persons are required to file the FBAR if

1. They have a financial interest in or signature authority over at least one financial account located outside of the United States, and

2. The aggregate value of foreign financial accounts exceeds $10,000 at any time during the year.

Which assets must be reported?

Different foreign financial accounts including bank accounts, mutual fund, trusts, pension and also other types of accounts are subject to reporting requirements.

The taxpayers are advised to use the year-end rate provided by the Treasury Department

When is FBAR due?

The form TD F90-22.1 is due by April 15 of every year. There is no extension to present this form. You’re allowed an automatic extension to October 15 if you fail to meet the FBAR annual due date of April 15.

Is FBAR filed with a US tax return?

FBAR is filed separately from a US tax return because it is not the IRS form. Moreover, even if a taxpayer is not required to file American tax return, this taxpayer has to file form TD F90-22.1 if the aggregate value of foreign financial accounts exceeds $10,000 at any time during the year.

What is the mailing address?

FBAR is not the IRS form. Form TD F90-22.1 must be sent to

U.S. Department of the Treasury

P.O. Box 32621, Detroit, MI 48232-0621

What are penalties for a failure to file form TD F90-22.1?

American expatriates must be aware that the penalties can be as low as $10,000 for each negligent violation  up to $250,000 or 5 years in jail for a willful violation. If a taxpayer breaks other laws in addition to FBAR, then the penalties can be as high as $500,000 or 10 years in jail. The latest FBAR case resulted in a jail sentence for a taxpayer from California.

up to $250,000 or 5 years in jail for a willful violation. If a taxpayer breaks other laws in addition to FBAR, then the penalties can be as high as $500,000 or 10 years in jail. The latest FBAR case resulted in a jail sentence for a taxpayer from California.

Conclusion

Although many American expats do not owe any tax after they file a US tax return, they might subject to penalties for a failure to file other forms like FBAR, FATCA, PFIC, controlled foreign corporation etc.

US citizens and also green card holders are advised to stay up to date with future developments.

The Author

ZM Ishmurzina, MBA, CPA. She is the principal at Artio Partners. Artio Partners is a CPA firm for American expatriates living abroad and dual citizens. We specialize in past due expat tax returns and complex international tax issues like FBAR, FATCA, foreign tax credit, foreign real estate, PFIC, foreign adoption and controlled foreign corporations. For more information please visit Artio Partners

Feel free to leave your comments on this blog. If you like this article, please feel free to share it on your social media.

If you like this blog, connect with me on Google+ or subscribe to our newsletter by clicking the banner below.

While we’re at it, I DO want to remind our readers that we appreciate any referrals you can send us. Finally, please remember the American-European real estate Group’s agents when you refer a real estate agent. Because we DO appreciate your business.